Pa Car Lease Sales Tax

The manufacturing processing or farming exemption does not apply to the lease of any vehicles required to be registered under 75 PaCS. Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of Philadelphia residents.

Consider Selling Your Car Before Your Lease Ends Edmunds

If the lease is exempt from sales and use tax it is also exempt from the 3 lease tax Im in Pittsburghwe have the extra 1 so my tax burden is 7.

Pa car lease sales tax. For vehicles that are being rented or leased see see taxation of leases and rentals. It is kind of confusing. P vra anlggningar kan du kpa ny bil frn BMW.

As far as I know the Sales Tax in Pennsylvania is 6 7 in Allegheny County and 8 in Philadelphia. Annons Boka en provkrning hos Bavaria din nrmaste BMW-terfrsljare. Similarly the grant of a right to use an electronic computer for a fee is subject to tax.

State Sales or Use TaxSales or Use Tax imposed by Article II of the TRC 72 P. But using the above example say the sales tax was 8 percent. This means you only pay tax on the part of the car you lease not the entire value of the car.

I did check PA laws and they do have sales tax rental tax but dont know if it matters if the car is out of state or not. Assuming that the sales tax rate is 6 3180 in sales tax would be due on the lease. The most common method is to tax monthly lease payments at the local sales tax rate.

Vehicle rental companyA business entity engaged in the business of renting five or more rental vehicles in this Commonwealth. The rental lease or license to use or consume tangible personal property is subject to sales tax. Boka provkrning redan idag.

If the lease is exempt from sales and use tax it is also exempt from the 3 lease tax. Add the additional 3 and I pay 10 on my lease payment. The sales tax for car-lease payments is based on the sales tax of the state where the car is leased at the time of the lease.

The bank I was leasing a car from is charging me a 9 sales tax on top of my Termination Fee. It could be paid in one lump sum or in installments along with the monthly payments in which case the tax would cost 8154 per month on a 39 month lease. P vra anlggningar kan du kpa ny bil frn BMW.

4 Manufacturing processing or farming exemptions. Any rentals for a maximum of 29 days will be subject to. Mobile homes which are titled by the Pennsylvania Department of Transportation also fall into this category and are subject barring other conditions to sales tax.

The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny County and a 2 percent local sales tax for vehicles. In the state of Pennsylvania any leases for a minimum of 30 days will be subject to an additional motor vehicle lease tax. I am ready to strike a deal with a dealer in PA but before I do they are saying I have to pay a PA lease rental tax along with MA sales tax.

VRTVehicle Rental TaxThe tax authorized under Article XVI-A of the TRC 72 P. Annons Boka en provkrning hos Bavaria din nrmaste BMW-terfrsljare. The lease of vehicles as well as supplies repair parts and accessories for the vehicles by any other public utility service are subject to tax.

Boka provkrning redan idag. I double checked a monthly statement and I. Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia.

The lease tax is in addition to the 6 percent sales tax which is also imposed. This protects people who lease from having a spike in how much they owe if state sales taxes are increased The sales tax varies by state. For example when a machine shop grants to another the right to use its machinery on weekends for a fee the transaction is taxable.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. The lease tax is in addition to the 6 percent sales tax which is also imposed. Doesnt matter if I am registering the car in MA I still have to pay 3 of this PA tax Is this true.

In a couple of states such as Texas lessees must pay sales tax on the full value of the leased car versus just the tax on payments during the time of the lease.

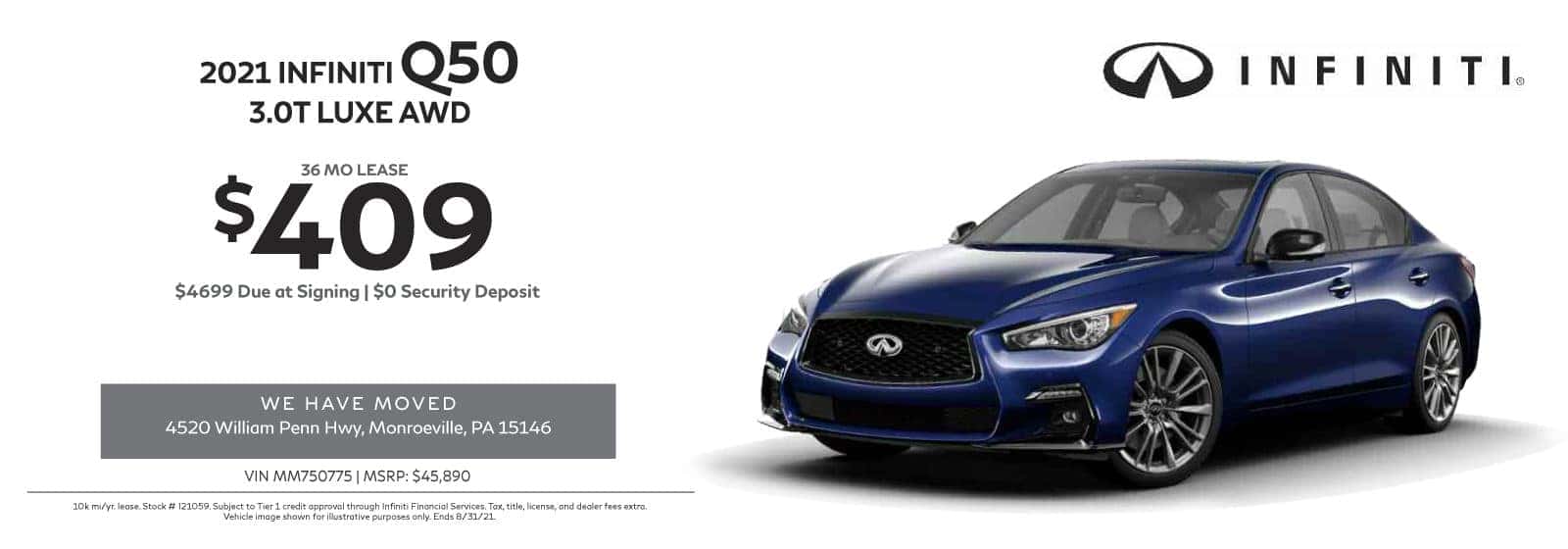

Cochran Infiniti Monroeville Monroeville Infiniti

What S The Car Sales Tax In Each State Find The Best Car Price

Leasing Versus Buying Taxes Bobby Rahal Honda Of State College

Tax Advantage Leasing Vs Buying Lancaster Toyota

Tax Advantage Leasing Vs Buying Lancaster Toyota

Should You Put A Big Down Payment On A Car Lease Carfax

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

What Is Pennsylvania Pa Sales Tax On Cars

Sales Tax On Cars And Vehicles In Pennsylvania

Expat Car Leasing Finance And Rental

How To Purchase Your Leased Honda Vehicle

What S The Car Sales Tax In Each State Find The Best Car Price

Car Lease Calculator Get The Best Deal On Your New Wheels Nerdwallet

Nj Car Sales Tax Everything You Need To Know

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Virginia Sales Tax On Cars Everything You Need To Know

What Is The Pennsylvania Sales Tax On A Vehicle Purchase Etags Vehicle Registration Title Services Driven By Technology

Post a Comment for "Pa Car Lease Sales Tax"