Ohio Sales Tax On Leased Vehicles

A lease is any transfer of the possession or control of tangible personal property for a fixed or indefinite term for consideration. The amount that is deductible is the amount you paid in 2014 at the signing of the lease.

How To Buy Or Lease An Electric Car Advice From Owner Who S Done It Four Times

If your lease is for business use you may deduct the sales tax as business vehicle.

Ohio sales tax on leased vehicles. The tax base is multiplied by the applicable sales tax rate seven per cent in each example. Be sure to look up your county tax rate on the Ohio Department of Taxation website. This protects people who lease from having a spike in how much they owe if state sales taxes are increased The sales tax varies by state.

Assuming that the sales tax rate is 6 3180 in sales tax would be due on the lease. The sales tax for car-lease payments is based on the sales tax of the state where the car is leased at the time of the lease. The full amount of tax due with the Sales Tax return filed for the period in which the leased motor vehicle was delivered to the lessee in this state.

Rule 810-6-2-10402 Trade in provisions do not apply when a rental or leased vehicle is exchanged for a new or used vehicle. For vehicles that are being rented or leased see see taxation of leases and rentals. For the examples involving sales of used vehicles sales tax is calculated on the total vehicle price as Ohio law does not allow a deduction from price for the value of a trade-in.

1 2002 and there are no changes to the original lease agreement there is no sales tax due to the State of Ohio. Ohio collects a 575 state sales tax rate on the purchase of all vehicles. If the rental period is less than 30 days the tax is due regardless of whether the lessor paid sales or use tax at the time of the original purchase of the property.

If you are interested in the sales tax on vehicle sales see the car sales tax page instead. Not all leases allow for a lease buyout so read the. But using the above example say the sales tax was 8 percent.

I thought the sales tax was calculated on the residual value only. In Virginia you pay full sales tax up front and receive no sales tax credit for your trade-in vehicle. Scroll to view the full table and click any category for more details.

On a used vehicle the tax is based on the current trade-in value according to the NADA guide. You can not deduct unpaid taxes on future purchases. When buying a vehicle from an auto dealer there are many options available to the consumer.

If the Ohio tax rate in a particular county is 60 the sales tax due on this lease would be 1088 times 06 648. For long -term agreements Sales Tax is due in full at the beginning of the lease. Simply multiply the sum of the figures from Steps 1 and 2 by your local tax rate.

If you live in the city and county of Philadelphia your tax rate is 10 percent consisting of six percent sales tax two percent local county surtax and two percent local city sales tax. It could be paid in one lump sum or in installments along with the monthly payments in which case the tax would cost 8154 per month on a 39 month lease. Upon first time registration of a vehicle in Kentucky the County Clerk collects a 6 usage tax.

The dealership is telling me that I will need to pay sales tax on the original price 22880 not the residual value of 14020. The way that the state of Ohio applies sales tax to car leases is based on the sum of lease payments. In New York Minnesota and Ohio you pay tax up-front on the sum of lease payments see New York Car Leasing and Ohio Car Leasing for more details.

Rule 810-6-1-22 When a trade-in vehicle is resold it is subject to sales tax. Must a dealership separately state the Sales Tax on the monthly invoice issued to the lessee. For example if you are purchasing a Ford Focus with a cash selling price of 18000 and a dealer documentation fee of 250 while living in Fulton county which has a 7 sales tax rate the total Ohio car tax is 127750.

For example in Ohio if lease payments are 300 a month and the lease term is 36 months the total of all payment is 36 times 300 10800. Taxability of Various Items in Ohio. There are also county taxes that can be as high as 2.

Most states only tax individual monthly payments and down payment. Calculation B in each example reflects this calculation. New or used automotive vehicle sales tax is levied on the net difference.

If your base monthly lease payment is 400 you will pay 40 in taxes per month 400 x 10 percent. If the lease was consummated in Ohio after Feb. Here we will provide information on how the sales tax applies to the different transactions that may occur.

If an Ohio resident assumes an out of state lease Ohio use tax may be due and payable up front on the remainder of the lease payments. This table shows the taxability of various goods and services in Ohio. You may deduct the sales tax you pay on a leased vehicle.

When you buy out your lease youll pay the residual value of the car its value at the end of the lease plus any applicable taxes and fees. Other items exchanged for full or partial payment are taxable. Arkansas generally does charge sales tax on the rental or lease of tangible personal property unless a specific exemption applies.

Tax credit may be obtained for any previous sales or usage tax paid to. Some dealerships may also charge a 199 dollar documentary service fee.

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Https Tax Ohio Gov Portals 0 Sales And Use Leasecomborev0306 002 Pdf

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

Https Www Michigan Gov Documents Sos 2020 Pa 159 160 Faq Trade In Credit 01012020 675449 7 Pdf

Lease Vs Buy Car Buying Lease Money Maker

Car Tax By State Usa Manual Car Sales Tax Calculator

Differences Between Leasing And Financing Your Toyota Toyota Toyota Brands Toyota Venza

New 20182019 And Used Cars At Kingsville S Great Lakes Used Cars Near Me Car Dealership Toyota Dealership

Vehicle Taxes Department Of Taxation

Memory Jogger List Template Why It Is Not The Best Time For Memory Jogger List Template Memories List Template Joggers

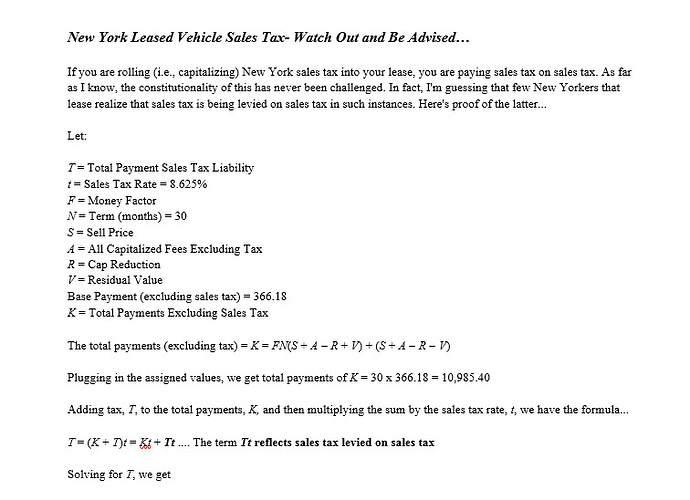

Taxes In New York Ask The Hackrs Leasehackr Forum

Https Tax Colorado Gov Sites Tax Files Sutt Motorvehicles 0 Pdf

Lease A Brand New 2014 Scion Tc For Only 199 Month Call Cain Toyota Scion For More Details 330 494 8855 Expires 1 6 Toyota For Sale 2014 Scion Tc Scion Tc

Lease A New Ford Fusion Wickliffe Oh At Nick Mayer Ford Ford Motor Company Ford Constructeur Automobile

Buy A New Ford Escape Beachwood Oh At Nick Mayer Ford New Ford Focus New Ford Explorer Ford Fusion

Rentals Leases How Does Sales Tax Apply To Them Sales Tax Institute

What S The Car Sales Tax In Each State Find The Best Car Price

Post a Comment for "Ohio Sales Tax On Leased Vehicles"