Ohio Car Registration Tax

25 House trailers travel trailers. Registration renewal taxes typically range from 5 to 25 but some localities do not have renewal taxes at all.

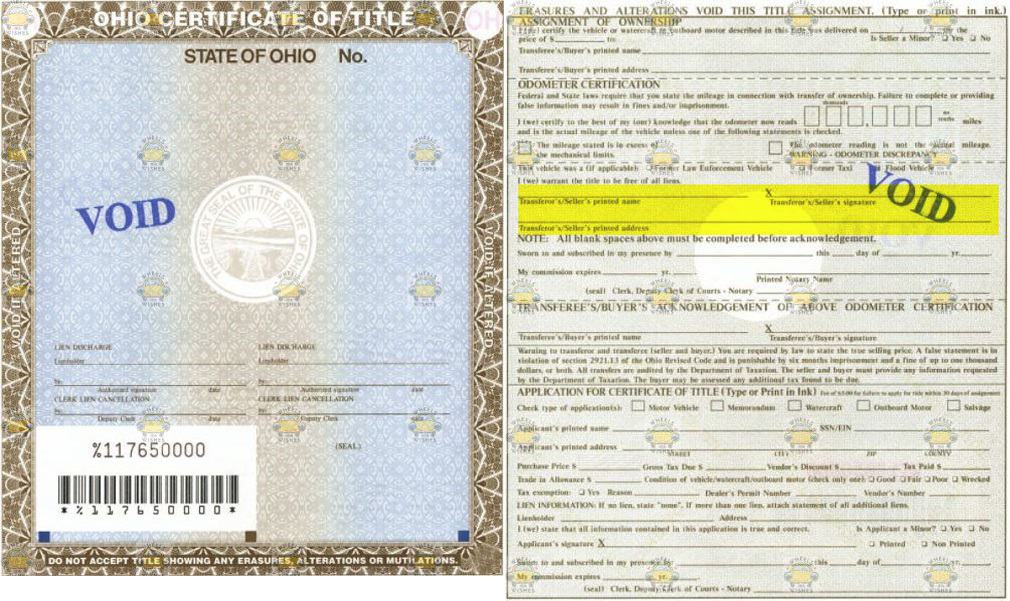

Ohio Vehicle Donation Title Questions

Owners of plug-in hybrids and electric vehicles now have to.

Ohio car registration tax. Non-commercial trucks no more than 34 ton and motor homes. Oregon has the highest registration fees in the US. Registration is available through the following.

You need to pay taxes to the county after you purchase your vehicle. According to the Sales Tax Handbook you pay a minimum of 575 percent sales tax rate if you buy a car in the state of Ohio. Vehicle Registration Related Fees.

State registration and titling fees are not taxed. Some states may require you to pay an additional registration fee if you own an electric vehicle or a hybrid. 31 House vehiclemoped.

House trailers travel trailers mopeds. Registration applications for a hybrid vehicle will be assessed an additional 100 fee per registration year. New Ohio Residents BMV Records BMV Investigations Crash Reports Insurance Companies Government Deputy Registrar Opportunity Detailed Statements of Motor Vehicle Registrations These reports include total registrations by county and vehicle type total registrations taxing district breakdown for each county by vehicle type revenue collected by county and total revenue collected.

May 11 2020. If you claim the mileage allowance for your business miles you cannot deduct the registration fee in addition. Ohio collects a 575 state sales tax rate on the purchase of all vehicles.

The fee is charged when a qualifying vehicle is registered for the first time and for all subsequent registration renewals. Some dealerships may also charge a 199 dollar documentary service fee. In addition to taxes car purchases in Ohio may be subject to other fees like registration.

Make an appointment Submit the required documents. Person or Business with Physical Presence in Ohio - Ohio law requires any person or business making retail sales of tangible personal property or taxable services to register for sales tax by obtaining a vendors license. The registration fees shown above do not include permissive local taxes which vary based on the.

These fees are separate from the taxes and DMV fees listed. 51 Zeilen Registration fees in Iowa are based upon the price and weight of the vehicle. County tax fees if applicable What Youll Do to Register your Vehicle in Ohio.

This can range from 50 to over 300 depending on the dealership and where you live in Ohio. Annual vehicle renewal registration fees do not include permissive local taxes which vary based on the taxing district and vehicle type. Please click here to learn more about Ohios licensing and filing requirements.

These taxes are flat fees which means that they are not based on your vehicles MSRP. Average DMV fees in Ohio on a new-car purchase add up to 48 1 which includes the title registration and plate fees shown above. Receive a temporary registration permit and registration stickers.

4 Ohio Bureau of Motor Vehicles. In fact part of the reason Ohio ended up with a funding gap is because vehicles are becoming more efficient. However if you use the actual cost method you may deduct the reg.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Non-commercial trucks more than 34 ton and. When a leased vehicle is a commercial truck or trailer the expiration date will be the last day of the month determined by the last two digits of the tax ID number or Social Security number of the lessee.

All title transfers and exemption claims on motor vehicles and other equipment is regularly audited by the Ohio Department of Taxation in accordance with Ohio Revised Code RC 450509 B 2 c and 573913 to verify if the sales tax liability has been satisfied. The following suspension types have a 40 reinstatement fee if they run longer than 89 days or are indefinite at setup time You may pay your reinstatement fees at any participating deputy registrar license agency with cash check money order or credit card. Between 26850 and 63650 for new vehicles and 122 and 306 to renew for two years.

Permissive tax is assessed in 500 increments and by law may be prorated by 50 if registering for 7 months or less. Fee in addition to gas repairs insurance and. In addition to the base vehicle registration fee Ohio requires that you pay any applicable local taxes before you can receive your renewed registration.

If buying from a dealership there is a good chance the dealership will charge a documentation fee. There are also county taxes that can be as high as 2. The ohio registration fee does not have a deductible part as some states do for the personal itemized deductions.

Remember these are only documentation fees charged by the dealer. A single base rate applies to these classes of motor vehicles. Ohio offers several different types of licenses.

Ohio Documentation Fees. Registration applications for an electric vehicle will be assessed an additional 200 fee per registration year. Receive your new Ohio license plates via US.

Less than 10 ton. For fleets staggered registration is an option. Visit your nearest deputy registrar agency optional.

For registration by mail or d if new plates are purchased fees for re ectorization 025 per plate and county stickers 025 per set.

Ohio Car Registration Everything You Need To Know

How To Register A Car In Ohio Bmv Registration Guide Dmv Connect

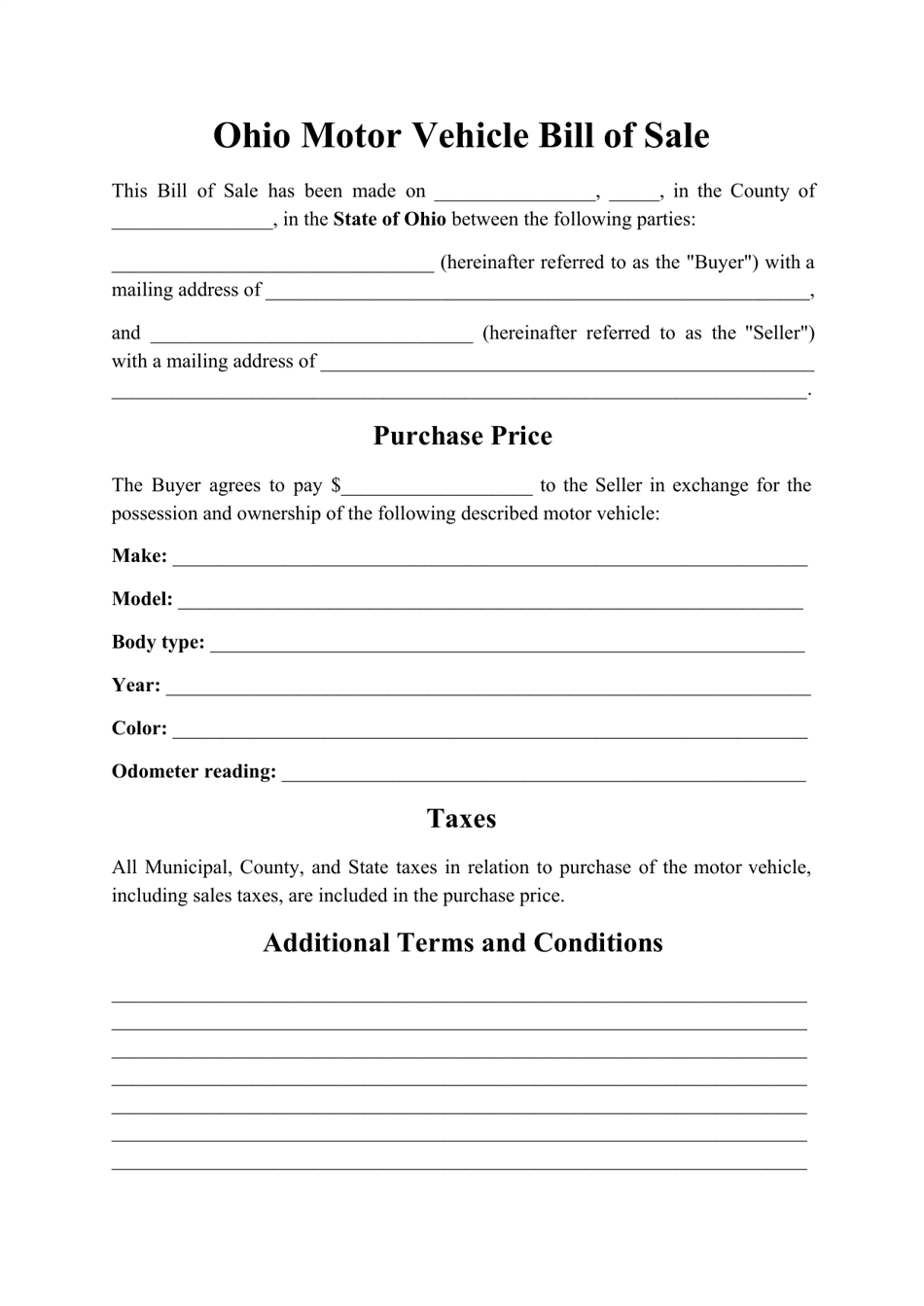

Free Ohio Motor Vehicle Dmv Bill Of Sale Form Pdf

Opinion Time For Ohio To Embrace Electric Transportation

2020 Form Oh Bmv 3774 Fill Online Printable Fillable Blank Pdffiller

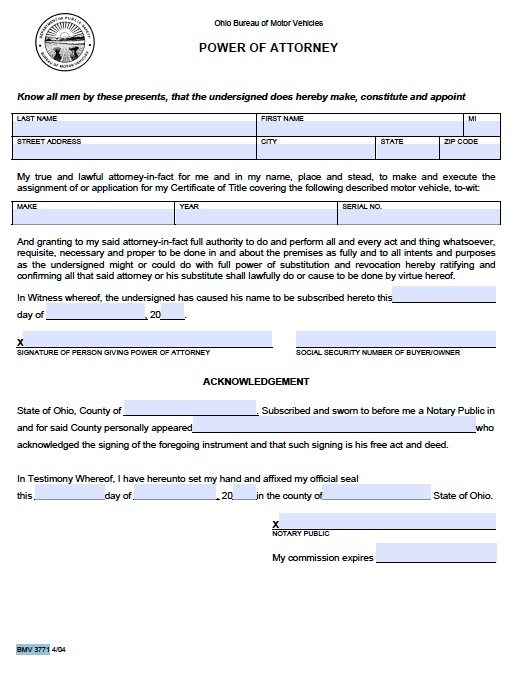

Free Motor Vehicle Power Of Attorney Ohio Form Bmv 3771 Pdf

Ohio Car Registration Everything You Need To Know

Vehicle Registration Ohio Fill Out And Sign Printable Pdf Template Signnow

Ohio Motor Vehicle Bill Of Sale Download Printable Pdf Templateroller

Ohio Reduces Fee For Late Vehicle Registrations

Https Clients Ohiosbdc Ohio Gov Documentmaster Aspx Doc 2721

Dmv Fees By State Usa Manual Car Registration Calculator

Ohio Car Registration Everything You Need To Know

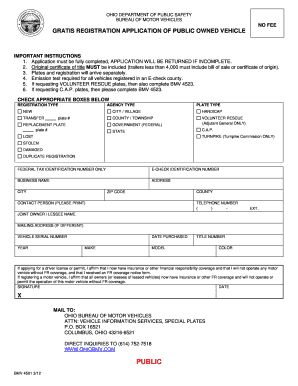

Https Publicsafety Ohio Gov Static Bmv3741 Pdf

As Ohio Raises Fee To Renew License Plates For A Short Time There S A Way To Save A Few Bucks Cleveland Com

Ohio Car Registration Everything You Need To Know

Ohio Car Registration Everything You Need To Know

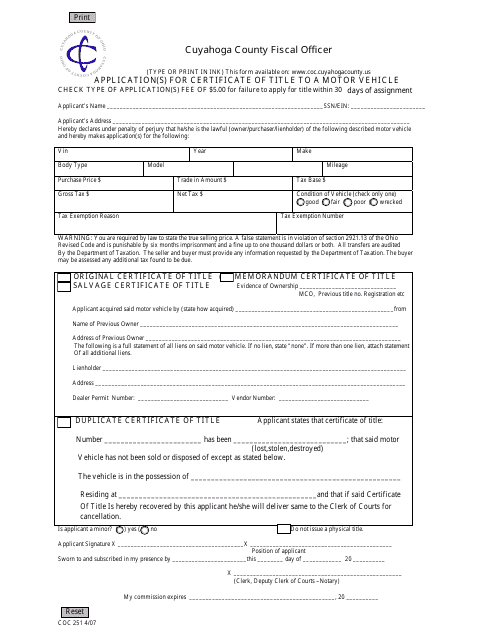

Cuyahoga County Ohio Application For Certificate Of Title For Motor Vehicle Download Fillable Pdf Templateroller

Post a Comment for "Ohio Car Registration Tax"